Prospects for aerospace manufacturing recovery post pandemic

In this article Alan Griffiths, Joe Brooker and Anastasia Prokhorova from industry analysts Cambashi examine how the aerospace manufacturing industry, and the software industry that supports it, has stood up to the impact of the COVID-19 pandemic.

Despite the airline industry being virtually grounded for long periods of time by the effects of the COVID-19 pandemic the aerospace manufacturing sector appears to have held up fairly well.

One of the key reasons for the aerospace industry’s resilience has been defence programs. They make up a large proportion of the industry and, being government-funded, have been relatively unaffected. Even commercial aerospace programs have shown some resilience, mainly because they are planned with such long lead times.

In addition, the space industry – a sub-set of the aerospace sector – has also continued to thrive throughout the pandemic as government programs have continued to invest, along with most of the commercial space companies.

The overall value of the aerospace industry in 2020 was estimated to be more than $US 500 billion. The US is the largest player – it dropped in value from $US 253 billion in 2019 to $US 205 billion in 2020. However, a figure of $US 244 billion is projected for 2021, largely related to government stimulus, the vaccination program, earlier release from lockdown in many states and gradual increases in commercial air travel.

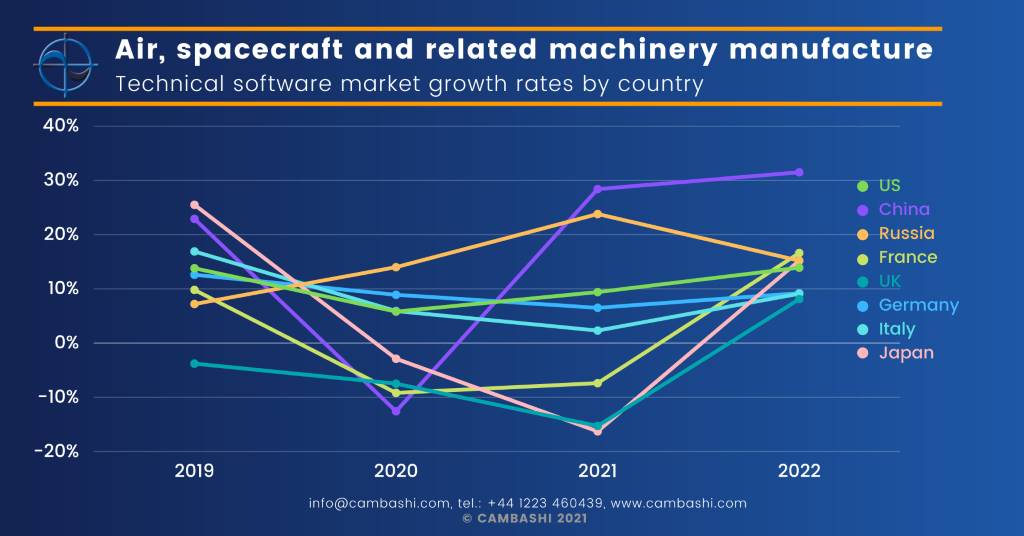

Most countries dropped in 2020 by around 20% due to the pandemic, but look set to show recovery to pre-pandemic levels or even higher. Although China had the biggest fall in 2020 (-28%), it is projected to have the biggest projected growth in 2021 at over 40%.

The shape of the aerospace market is also changing and players are entering different areas of the supply chain – especially in the aftermarket business, an area where Tier 1 (T1) companies have seen great success over the years. One of the most lucrative aftermarket areas is the high-pressure turbine which often requires the most maintenance and where non-OEM replacement parts cannot be used because of the safety risks. This is attracting many of the aerospace OEMs to enter further into the T1 aftermarket business.

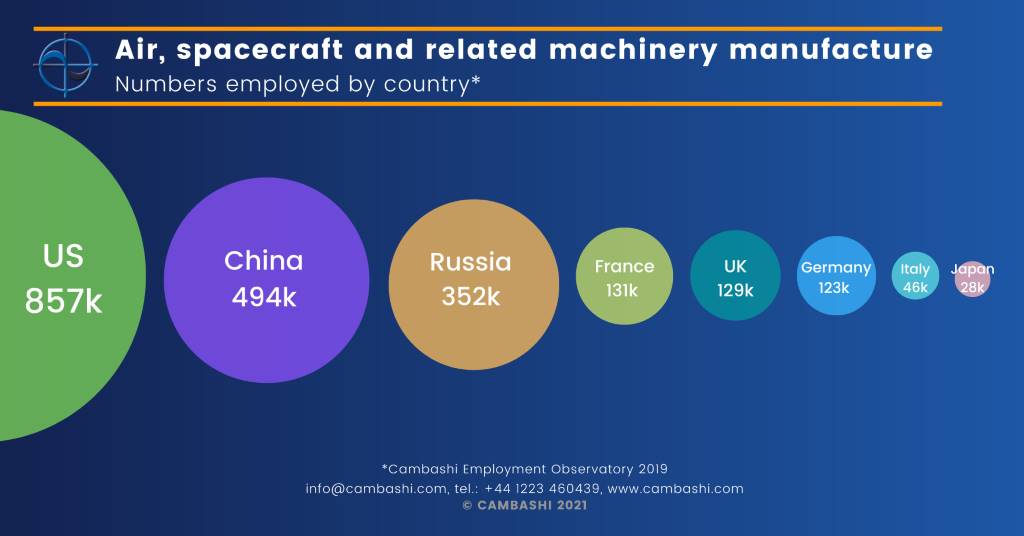

Employment levels

In terms of the numbers of people employed in the aerospace industry (including spacecraft and related machinery), the US again leads, with over 850,000 employed. China is second with nearly 500,000.

Given the low software sales in China, this represents an opportunity; even though it is not realistic to expect thousands of people to suddenly become CADCAM or simulation experts, this is an attractive market for visualisation and AR/VR (augmented and virtual reality) software that can provide front line workers – such as on the shop floor and in maintenance positions – with valuable information and training.

The market for ‘technical’ (PLM, CAM, MCAD and MCAE) software used in the aerospace industry globally is again dominated by the US, with nearly $US 1 billion of 2020 sales, followed by France with $US 210 million, Germany with $US 120 million and the UK with $US 70 million.

The US technical software market continues to grow steadily despite the pandemic, showing the importance and resilience of the software market.

The market for Computer-Aided Technologies (Mechanical CAD, Mechanical CAE, CAM) and PLM software sectors in the global aerospace sector is worth approximately $US 1.7 billion annually. Surprisingly, MCAE is bigger than MCAD, showing the increasing importance of engineering analysis and simulation in the aerospace sector.

Aerospace market size by technical software type (MCAE, MCAD, CAM and PLM)

Historically, the MCAD market in aerospace was much larger than MCAE, but the MCAD market is flattening out while MCAE continues to accelerate. The need for virtual and remote working is another factor that is driving both MCAE and MCAD investment.

Potential markets

China, the fourth largest player in the aerospace industry, is only eighth in the software chart, at just over 1% the size of the US market, meaning there is potential for software growth. However, because of the relatively small size of its current market, the absolute increase won’t be significant.

China is also notoriously difficult to sell software into as it has experienced high levels of software piracy. This shows in the relatively poor engineering software sales in China in recent years despite the relative strength of China’s manufacturing industry.

Russia has similar characteristics, being a substantial player in the aerospace industry but only seventh in the software chart at about 2% of the size of the US market. Russia can also be difficult to sell software into because it has its own software industry and the Russian Federation mandates "preferential use" of Russian software by enterprises with Critical Information Infrastructure – which would apply to aerospace.

However, the biggest opportunities for software sales will still be in the leading markets shown in the software chart due to their maturity and record of strong growth.

Engineering software applications typically outperform the underlying economy of the industries they serve. When looking at the ratio of technical software spend to Value Added, there has been a steady increase over the past 10 years in the aerospace industry. This shows the importance of engineering and technical software in driving advancements and efficiency gains in the industry. The spike in 2020 is due to the overall industry’s Value Added falling sharply in response to the COVID-19 pandemic, while technical software spend held up well.

Although the aerospace software market growth in most countries dipped in 2020 due to COVID-19 effects, we forecast it to recover to pre-pandemic levels or higher in 2022 and then continue growing with a CAGR of nearly 10% from 2019 to 2025.

Conclusion

Research for Cambashi’s Insights, combined with data from our software and employment Observatories, shows that the aerospace manufacturing industry has stood up well through the COVID-19 pandemic and is already returning to pre-pandemic levels, or better.

This is partly due to the defence sector, which has been relatively unaffected and partly because of the space industry, which is a thriving sub-set. Both areas have advanced products with complex supply chains that require sophisticated design/engineering/manufacturing software.

China is of interest since, while it has one of the largest aerospace manufacturing industries, it is one of the smaller software consumers. Combined with the fact that China is second only to the US in employment numbers in this sector, this suggests significant opportunities for software and services – though caution is required. Software vendors will need in-country presence, established reference customers and sound software control to leverage this opportunity and succeed in these markets.

Cambashi